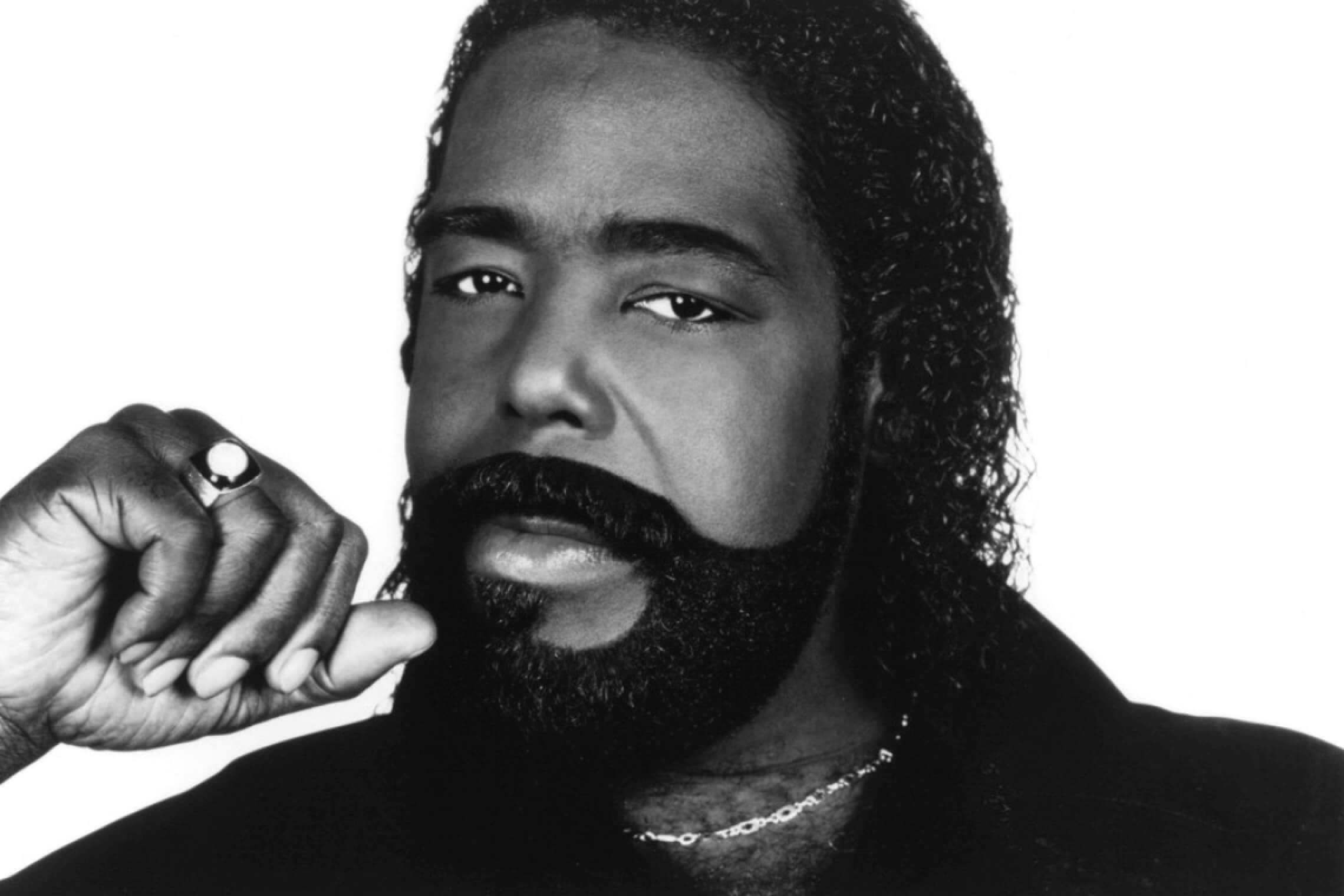

Legendary singer Barry White is calling out from his grave to send people with old estate plans a message: when it comes to updating your will, you Can’t Do Enough Updating, Babe. When White died in 2003 at the age of 58, his girlfriend Katharine Denton had recently given birth to their daughter. He always told Katharine that he would take care of them for the rest of their lives. They’d been together for nine years already, so she assumed he would keep his promise even from the great beyond. White knew he was in poor health but he had a will. So how do you think that worked out for them?

Unfortunately, not very well! White had an estate plan but it had not been updated in many years. During that time, White’s life totally changed. He separated from his second wife Goldean James, but they never divorced. Although White had nine children, the estate plan gave everything to Goldean. All of the kids and Katharine were disinherited. This sparked a legal battle that didn’t turn out well for Katharine Denton or his progeny.

It’s crucial to keep your will up-to-date to ensure that your final wishes are fulfilled. In this blog post, we will discuss when you need to update your will, with a little help from the Walrus of Love.

Changes in Your Marital Status

Your marital status plays a significant role in your estate planning. If you get married or divorced, it’s important to update your will to reflect your new status. Failure to update your will after getting married could lead to your spouse not receiving the assets you intended to give them. In contrast, not updating your will after getting divorced could mean that your ex-spouse inherits a portion of your assets. The lesson is you must update your will after any significant changes in your marital status.

Glodean James married White in 1974 and they separated in 1988. They had been separated for over 15 years by the time he died, yet she inherited his entire kingdom. James allowed Denton to live in the home she shared with Barry but other than that, Denton was on her own. White may not have wanted Glodean to be His First, His Last, His Everything but since he didn’t change his will, that’s what happened.

White should have followed through with divorcing Glodean James. In California, that would have invalidated his old will. But even if he - or you - are in the middle of a divorce, you need to update that estate plan. This is doubly true if you’ve moved on to a new love.

Changes in Your Family Status

Changes in your family status such as the birth or adoption of a child, the death of a family member, or the disinheritance of a family member should make you review your will to make sure it still lines up with your wishes. The birth, adoption, or guardianship of a new child should prompt you to update your will to include them and determine how your assets will be distributed. If a family member named in your will passes away, you may need to make changes to your will to reflect this.

Barry White didn’t mean to disinherit his kids, but when he made the will he was in his late 30s and he figured James would handle everything. His life changed a great deal after that, with a daughter being born right before he passed away. White also had an adopted daughter named Denise who was born during her mother’s relationship with the singer in 1962, when White was still a teenager. Denise wasn’t his biological daughter but he supported her, changed her surname to White, and gave her a job. When Denise told Glodean James she was going to sue for her share of the estate, James promised to give her a cut. After ten years of payments though, James cut her off.

The same thing happened to White’s son Daryl. He was the biological son of the later singer. Daryl told James was going to sue for a portion of the estate and James promised she would take care of him. But after a decade, James unilaterally stopped the payments. James was not legally obligated to take care of Daryl or the other children. If White had created a trust for his children, he could’ve provided for all of them.

Changes in Your Financial Status

If your financial status changes significantly, you should review and update your will. This could include a substantial increase or decrease in your assets or a change in your financial goals. You may also want to review your will if you have incurred a significant debt that could impact how your assets are distributed after your death.

When White died in 2003, the value of his music catalog was pretty high. But that’s nothing compared to its value in 2023. The value of music copyrights has skyrocketed in recent years. Bob Dylan sold the rights to his entire oeuvre to Universal Music Publishing Group for $300 million. Stevie Nicks sold 80% of her copyrights for $100 million. Bruce Springsteen got $500 million from Sony for the rights to his music. Motley Crue’s rights got $90 million. Who knows if this gold rush in music rights will continue, but White’s reputation has only grown since his death. His music rights have probably quadrupled since then.

Changes in Your Health Status

If you experience a significant change in your health status, it’s important to review and update your will. This could include a diagnosis of a serious illness or a disability that may require long-term care. Updating your will to reflect these changes can ensure that your assets are used to provide for your care or the care of your loved ones.

White was just 58 when he died. He had suffered from diabetes and high blood pressure and was hospitalized with kidney failure in 2002. White had a stroke in 2003 while awaiting a kidney transplant. With these serious health concerns, he should have been meeting with estate planning experts ASAP.

Changes in Tax Laws

Tax laws change frequently and it’s difficult for people without CPAs to keep track of the changes. Reviewing and updating your will can help you take advantage of any new tax benefits or exemptions that may be available to you.

Like a lot of people, Barry White was busy raising children and battling serious health problems as he got older. He wasn't in a position to know if his estate plan needed to be updated because of new tax laws.

Changes in Your Executor or Trustee

If the executor or trustee named in your will is no longer able or willing to serve in that capacity, you will need to update your will to name a new executor or trustee. It’s also important to name alternate executors or trustees in case your primary choice is unable to serve. If you named your spouse and then decided you no longer trust that person, then you need to remove them as executor or trustee. White Had So Much to Give and now his widow is poised to make a killing on the rights to his songs because she was the only person named to take the role of executor. White should have appointed someone he trusted to oversee his most important asset.

A will is a vital legal document that should be updated periodically to reflect changes in your life. By keeping your will up-to-date, you can ensure that your final wishes are fulfilled and your assets are distributed according to your wishes.