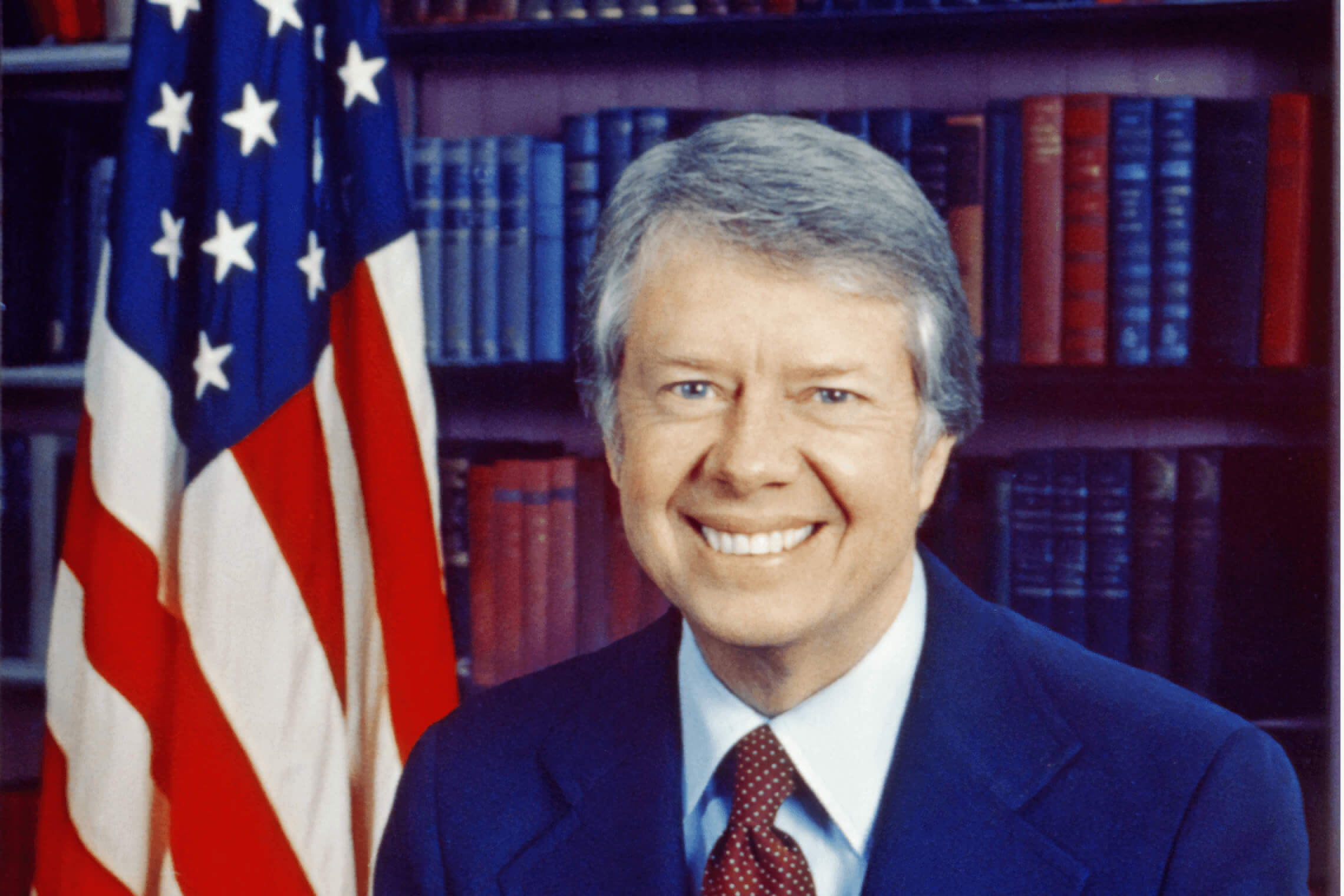

Former President Jimmy Carter has now entered home hospice care, marking the end of a highly productive and unusual life. While there’s a debate about whether Jimmy Carter was a great president, there is no debate about whether he was a good man. After Carter served as president, he helped build thousands of houses with Habitat for Humanity and established the Carter Center which promotes fair elections abroad. The Center also helped eradicate the Guinea worm parasite in developing countries. Carter taught Sunday School for over 50 years.

At 98, Carter is the longest-lived American president and although we don’t have access to his actual will, we do know a lot about his estate plan. Here’s what you need to know about Carter’s Estate Plan.

The Carter Peanut Farm and Blind Trust

James Earl Carter, Jr. was born in 1924 on his parents’ 360-acre farm in Plains, Georgia. At the time, “three acres of land produced a ton of peanuts, generating about sixty dollars in income, which for the time was an excellent return.” In 1953, Carter’s father died and Jimmy resigned from the Navy in order to manage the farm and farm supply business. Carter expanded the business to selling seed peanuts, supplying liquid nitrogen, fertilizer, and lime, among other agri-products.

Before Carter was sworn in as president in 1977, he put his peanut farm in a blind trust. The owner of an asset put in a blind trust establishes the terms of that trust before he surrenders control of it. The trust can expire after a certain period of time (such as 10 years), or until a specific event (like an heir reaching age 21 or a person losing a bid for reelection). A blind trust separates the donor of the trust from its management. The Carter family believed that the blind trust would avoid a conflict of interest and the appearance of any conflict of interest while he was in office.

An Atlanta law firm became the trustee of the farm supply business. Under the terms of the blind trust, the Carters weren’t able to know anything about how the business was being managed, not even its profit and loss numbers, while the trust was in effect. When Jimmy and Rosalind returned to Plains in 1981, Trustee Charles Kirbo informed the family that the farm was $1 million in debt because of drought conditions and warehouse management issues. To pay the debt, the Carters sold the farm.

The Ethics in Government Act

You may wonder whether presidents are restricted from owning businesses while they serve as presidents. The short answer is no, presidents are not bound by the same conflict of interest laws that other federal employees must follow.

The Ethics in Government Act requires that certain high-level government officials, including the President, Vice President, and members of Congress, file financial disclosure statements that provide information about their personal finances, including income, assets, and liabilities. These disclosure statements are intended to help prevent conflicts of interest and ensure that government officials are not using their positions for personal gain.

However, there is no law or ethical rule that requires presidents to put their assets in a blind trust. Other presidents have used blind trusts. The Bush family came from old money and both George H.W. Bush and George W. put their assets in blind trusts upon entering the presidency. Bill Clinton also put his assets in a blind trust. When Barack Obama was elected Senator, he established a blind trust to manage his investments. Later that same year he liquidated his stocks and closed his trust because "he realized that this arrangement did not adequately protect him against even the perception of a conflict of interest." As president, Obama chose not to own any stock. His investments in treasuries and diversified funds had to be fully disclosed under the law.

Trump’s Revocable Living Trust

Since there are no restrictions on what a president does with his property, investments, and businesses, Donald Trump structured his presidency differently. Trump entered the presidency with vastly more wealth and assets than his predecessor. Trump put his businesses in a revocable living trust when he assumed the presidency. A revocable living trust gives the donor, in this case, Trump, the right to end the trust and recover the trust assets at any time. Trump’s trustees were Trump Org CFO Allen Weiselberg and Trump heir Donald Trump Jr. (You can view part of the Trump document here.) The revocable trust allowed Trump to take money from the trust at any time without informing the public. There were no restrictions on communications about the trust assets, so Trump wasn’t prevented from discussing business with Jr and Weiselberg. Trump’s businesses made $2.4 billion while he was in office, according to Forbes.

Carter’s Pension and Income

Carter’s annual pension from serving as president is $210,700. After Carter lost the 1980 election, he chose not to give paid speeches or sit on corporate boards. Carter said he didn’t want to “capitalize financially on being in the White House.”

Carter instead turned his attention to writing and teaching. He wrote 33 books and taught for over 30 years at Emory University. In contrast, Obama signed a development deal with Netflix and the publishing deal for his memoir was for over $60 million, while Trump promoted NFTs.

Rosalyn Carter can opt to receive a $20,000 annual pension which is provided to presidential spouses.

Jimmy Carter’s Property

According to the Washington Post, “Carter is the only president in the modern era to return full-time to the house he lived in before he entered politics — a two-bedroom rancher assessed at $167,000, less than the value of the armored Secret Service vehicles parked outside.”

Plains is still an impoverished area of Georgia, with a poverty rate of 40 percent. The ranch house at 209 Woodland Drive remains the only home the Carters have ever owned. The one-story ranch house will not pass by will to Carter’s children because the Carters already have deeded the property to the National Park Service. The Carter House will become a museum along with other property that is already part of the Jimmy Carter National Historical Park. The park includes a pond that Carter dug himself, a train depot that served as his campaign headquarters, and his boyhood farm, which still supplies the Carter family with vegetables. The Carters intend to be buried at the park with simple headstones. They told reporters they hope the National Park will draw tourists and help the Plains economy.

Estate Planning Lessons from Jimmy Carter

Although many people choose to leave their assets to their family, you have the option of leaving your estate to a charity. In fact, leaving a charitable bequest in your will is a common way to support a cause you care about after you pass away.

To do so, you will need to include specific language in your will or trust that designates the charity as a beneficiary. You can specify a percentage or a specific dollar amount of your estate to go to the charity. It is important to ensure that the charity you wish to support is properly identified and legally recognized.

If you are considering leaving a charitable bequest, you can use FastWill to draft a legally sound and effective will or trust that meets your needs.